tax avoidance vs tax evasion hmrc

It even makes big news for celebrities and large multinationals. A HMRC spokesman told the BBC in an article from 2014 on tax avoidance that.

Tax Avoidance Vs Tax Evasion What S The Difference Informi

If you do believe that you have entered into a tax.

. So whats the difference between tax avoidance and tax evasion. Crossing that line can. Tax evasion is the deliberate non-payment of taxes that is illegal.

Theres a different way to report suspicious HMRC emails text messages and phone calls benefit fraud excluding Child Benefit and Tax Credit. Tax avoidance is defined as legal measures to use the tax regime to find ways to pay the lowest rate of tax eg putting savings in the name of your partner to take advantage of. Avoiding tax is legal but it is easy for the former to become the latter.

It always creates a lot of anger and questions about how to get away with. However the simple difference between the. As you can see its not just a question of tax evasion vs tax avoidance but we also need to ask if the avoidance is acceptable.

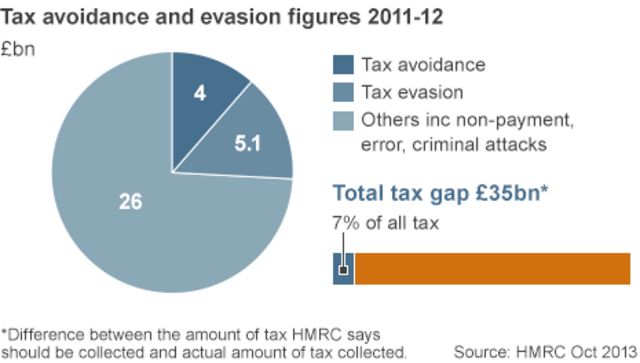

Tax avoidance is bending the rules of the tax system to gain a tax advantage that Parliament. This policy paper sets out the governments approach and achievements in tackling tax avoidance evasion and other forms of non-compliance. Tax evasion is illegal and considered fraud which involves breaking the law for example deliberately hiding the trading revenue or using tax avoidance schemes.

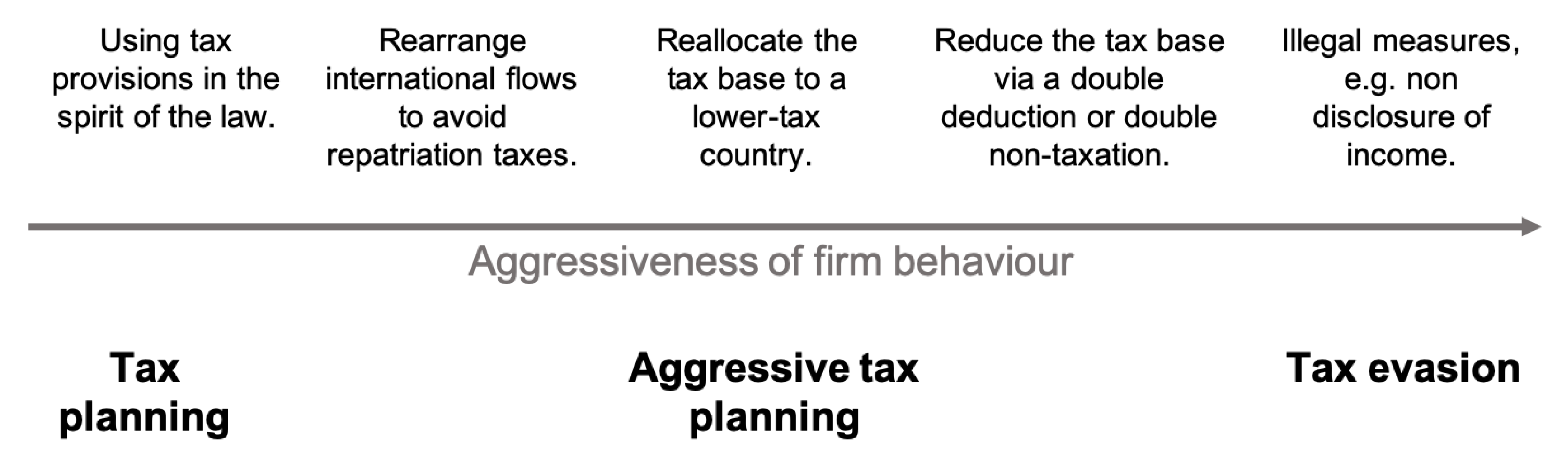

However there are many occasions where this is taken to the extreme and this is known by HMRC as aggressive tax avoidance. Tax avoidance means exploiting the system to find ways to reduce how much tax you owe. Tax evasion means concealing income or information from the HMRC and its illegal.

It is split into three. Tax evaders are bad for the. Tax avoidance is structuring your affairs so that you pay the least amount of tax due.

The difference between tax evasion and tax avoidance largely boils down to two elements. The difference between tax avoidance and tax evasion is that tax avoidance schemes operate within the law but are described by HMRC as not being in the spirit of the. It is in these cases where after an investigation HMRC.

HMRC defines Tax Evasion as Concealing of taxable income or the use of benefits to avoid the tax payment Tax. In fact HMRC you should be making tax clearer and simpler so that avoidance is easier and fairer for all. Understanding how tax evasion and tax avoidance compare is key to avoiding landing yourself in hot water or worse committing a criminal offence.

Tax avoidance has always created interesting news. The difference between tax avoidance and tax evasion essentially comes down to legality. Before we define both terms - which differ from one another to an extent - its worth pointing out that both activities are.

Other types of tax avoidance or tax evasion.

Tax Avoidance Evasion What S The Government Doing

Uk Tax Evasion Crackdown Expected To Net 2 2bn Financial Times

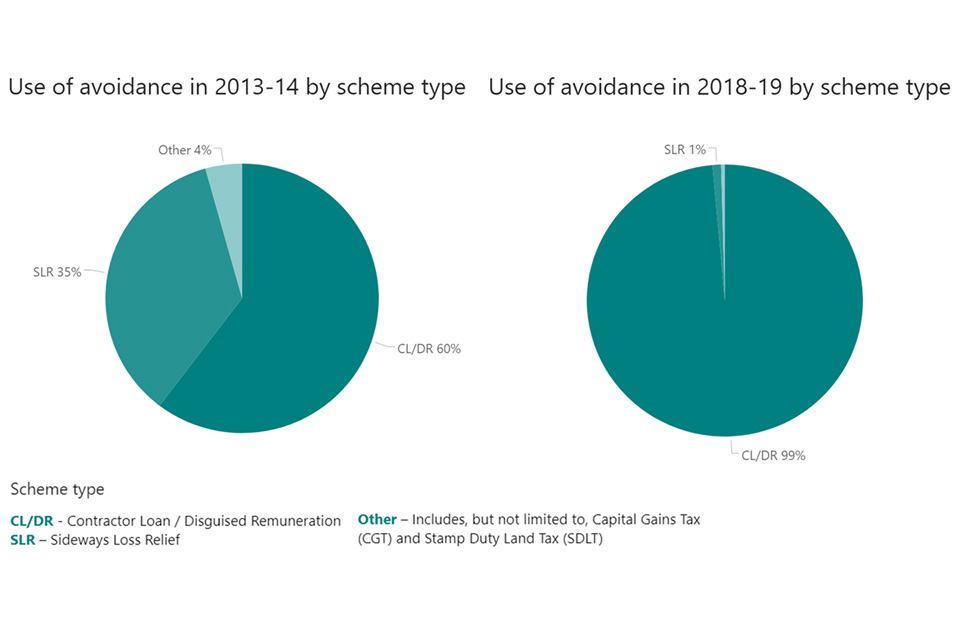

Use Of Marketed Tax Avoidance Schemes In The Uk 2018 To 2019 Gov Uk

How Do You Solve A Problem Like Tax Avoidance What S The Scale Of The Problem Waiting For Godot

Follow The Money An Exercise In Tax Evasion And Avoidance

Most People Think Legal Tax Avoidance Is Just As Wrong As Illegal Tax Evasion Poll Suggests The Independent The Independent

Tax Compliance Literature With Red Board Pin Re Taxation Taxes Avoidance Evasion Self Assessment Hmrc Etc Uk Stock Photo Alamy

The Nurses Story Failed Tax Avoidance Payadvice Uk

Hmrc Receives 73 000 Tax Evasion Reports Ftadviser Com

Tax Avoidance Tax Planning And Tax Evasion What S The Difference The Accountancy Partnership

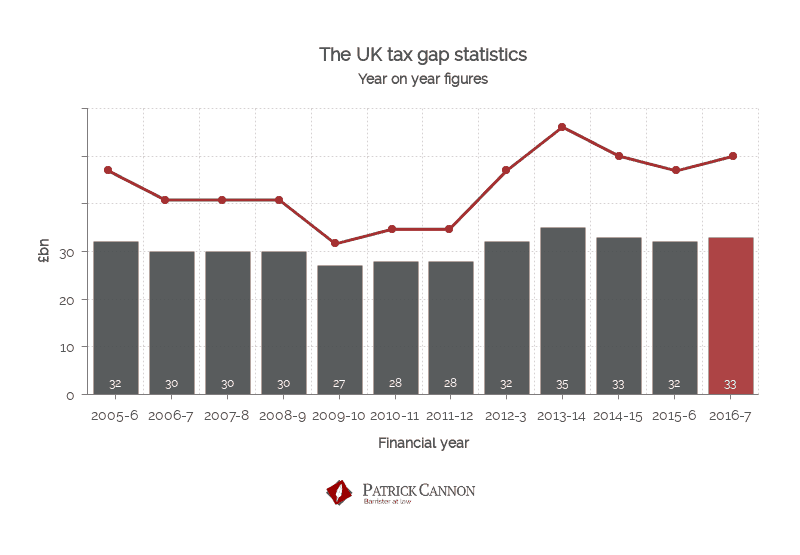

Tax Evasion Statistics 2020 Uk Tax Evasion Facts Patrick Cannon

Hmrc Report Details Tax Avoidance Scheme Industry In The Uk Taxlinked Net

Hmrc Empowered To Name And Shame Tax Evasion Enablers Tax Avoidance The Guardian

Tax Evasion Vs Benefit Fraud R Ukpolitics

Tax Avoidance What Are The Rules Bbc News

Games Free Full Text Gaming The System An Investigation Of Small Business Owners Attitudes To Tax Avoidance Tax Planning And Tax Evasion Html

Serious Consequences For Tax Avoiders As Hmrc Narrows On The Gig Economy Lawyer Monthly Legal News Magazine

Tax Avoidance Vs Tax Evasion What Is The Difference Cardens Accountants